Pricing an empire

Our project ‘Mafias in Africa’ has unearthed an unprecendented amount of information regarding Italian organized crime’s influence in African economies. Most probably, what has been uncovered is just the tip of the iceberg. Yet, the tip is huge enough to allow at least a very partial estimation of the value of the largest empire, that of Vito Roberto Palazzolo, a.k.a. Robert Von Palace Kolbatshenko, currently detained in Milan for Mafia association, after having escaped justice for well over a decade.

As thoroughly exposed by the project’s investigation, from 1986 onwards Palazzolo has been building a vast entrepreneurial empire that touched South Africa, Namibia and Angola, with long arms that have reached presumably Russia and the Far East. With only incomplete and poor data in hand, Quattrogatti and Irpi have been trying to partially estimate the value of some of the entreprenurial adventures presumably involving Palazzolo throughout the years. The results are numbers that, despite their deep uncertainty, urge for the attention of policy makers, and call for radical reforms on how to collect information and combat globalised economic and financial crime.

Some Clarity in the mist: quantifying assets and properties

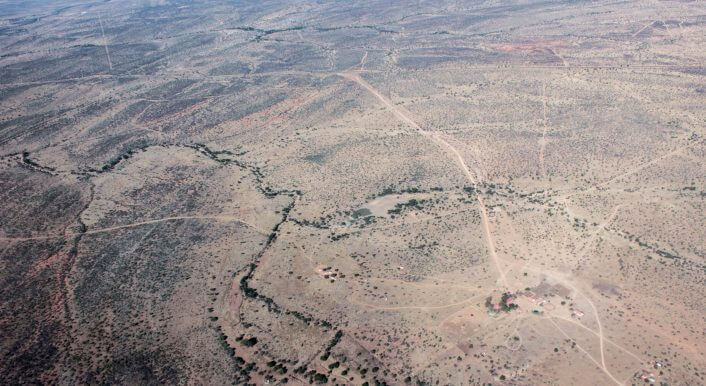

According to the investigation results, the economic net surrounding Palazzolo is composed of about 200 companies. This quantity accounts for all the companies in which Palazzolo, a member of his family, or a close associate as stated by prosecutors reports, acted or are active as board members. The net includes many companies which are no longer active, thus shedding light onto the history and dynamics of Palazzolo’s empire activities. Most of the companies are located in South Africa; information about companies in other countries, namely Angola, Namibia, Hong Kong and Lichtenstein, has been gathered too. Overall, most of the companies appear to act in five key sectors: construction, international trade, financial intermediation, agriculture, and mining. Knowing the exact number of companies involved in each sector has not been possible due to missing data.

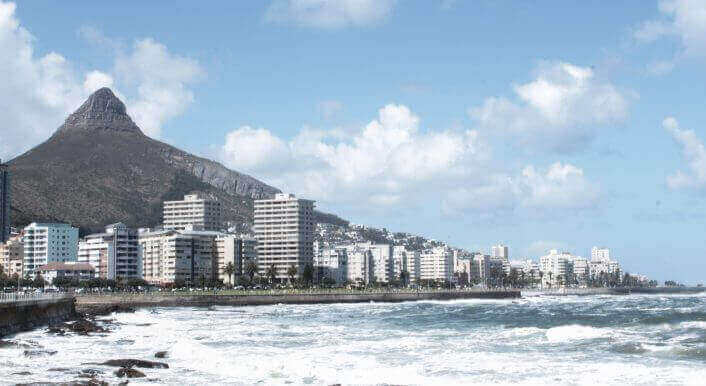

With a vast company net comes also a vast property portfolio. The project succeeded in identifying about 70 properties across South Africa and Namibia, which are owned or have been owned directly by Palazzolo, a family member or a company linked to the net. Preliminary calculations suggest that the minimum value of the property net amounts to about $41 million (see Methodological Note 1). The properties all reflect luxurious tastes: from highly expensive apartments located in Cape Town’s Bay Area to large villas in the South African winelands. With house and land prices expected to grow as economic growth drives South Africa and Namibia, these properties represent an extremely high-value, long-term investment.

Palazzolo seems to have speculated in several mining activities in the 1990s. Along with high-profile political individuals in Angola, he set up a number of companies managing mining concessions of immense value. Gema Dourada’s diamond concession appears to feature an average of 0.55 carats per cubic meter, with an overall estimated value of $200 million. Feasibility studies indicate that three other Angolan diamond concessions – Diagema, Kupolu and Somicoa – contain a minimum of 400,000 carats, thus reaching an estimated value of $80 million. Until the late 1990s, Palazzolo is even linked to a 17% ownership of Severalmaz, the company dealing with the famous Lemonosov diamond deposit in Russia, whose total value reaches the astronomical amount of $12 billion.

Apparently, the man did not dislike other precious resources, such as uranium. Investigations have linked him, together with Namibian Zacharius ‘Zacky’ Nujoma, to uranium mining rights then sold to the Forsys Metals Corp. Today, Namibian uranium mines owned by the latter company have an estimated value of $3.5 billion, with an economic analysis giving Forsys a pre-taxt net present value (NPV) of about $622.6 million. More information on where these numbers come from is provided in the Methodological Note 2.

Lesons learnt: the long way to good data and better policy making

The project, in many ways, has been a success. Not only did it untangle the historical and current roots of the African economic empires of some important organized crime members, it has also documented their poisonous effects onto African societies. Criminal money corrupts and renders governments illegitimate. Mr. Palazzolo fuelled millions into the enterprises of Namibian first President’s son, Zacharius ‘Zacky’ Nujoma; placed former top political Angolan political figures – such as General Jose Joao Mawa Mawa, President Eduardo Dos Santos, Vice-Minister of Defense Julio Mateus Paulo – in the management of his diamond concessions. He also allegedly owned important chunks of South African police forces, namely Neels Venter, former head of anti-serious crime unit.

Criminal money, when entering the legitimate economy and politics, distorts its functioning and makes it addicted to the illegal flow of money. Corruptible decision makers would align their interests with those of criminal entrepreneurs, thus discarding their responsibilities as public officers. At the end of the day, you end up in a country with a higher short-term GDP values, but with disastrous long-term consequences with respect to governance and economic equality. The money generated by a corrupted elite does not trickle down. It stays within the corrupted elite.

The project has been, in many ways, also a failure. A good one, as it highlights several shortcomings that can only be addressed with concrete trasnational policy reforms.

Integrating and better access to company data. Finding good quality company data is a tremendously difficult and expensive task when these companies are located in Africa. Data about cash flows (which would have been essential to estimate the economic value of Palazzolo’s economic network), for instance, has been impossible to attain. Both African and international parties should grant civil society the instruments to collect this type of information. That implies an open data policy based on the digitalisation and standardisation of company data across Africa and the world.

Crashing the walls surrounding trusts. The picture on Palazzolo’s empire surfaced during the project is an incomplete one. Many facets appear to be hidden behind his offshore entity, the Von Palace Kolbatshenko Trust. Getting information on the Trust’s activities is a daunting task even for prosecutors. The example indeed serves as a further piece of evidence supporting international action for a more transparent regulation of offshore activities, and the need for access to Trust information when actors are involved in criminal activities.

Asset confiscation in African countries. At the heart of the Mafias’ influence in Africa is money. Seizing the assets of those who have been proven guilty of organised and financial crime represents a huge step forward in dwarfing their economic power. Asset confiscation policies, though, appear to be poorly implemented, often non-existent. As in Europe, African countries ought to start devising a transnational anti-crime solution involving this measure.

Data science must enter the stage. Data science – the use of statistical and machine learning methods to infer or predict patterns – can become the most important instrument for those who want to track and prevent criminal infiltration in the economy, both in Africa and abroad. After implementing efforts to ease access to company data, it is possible to develop models that monitor and predict the risk of a geographic area or an economic sector being infiltrate by organised crime. Such an approach would overturn the fight against Mafias by accelerating the tracking of their actions, or even predict it.

Methodological note 1: Estimating property values

41 million is an estimation of the nominal value in current US dollars of the properties linked to Palazzolo that the investigation has found. By linked, it is meant properties currently owned or that have been owned by him, a close associate, or by a company to whom he is a director or a close associate. For each property, its purchase or sale value in local currency has been converted to US dollars using the respective historical exchange rate. An estimation of the likely current value of the properties has been calculated by adjusting their historical value by the change in the house price index of the respective country. The current value of Namibian properties has been estimated by leveraging on expert information. Readers should be aware of the tentative nature of the estimation: quantitative information about many properties is missing. We expect this value to change once more data is collected by future work.

Methodological note 2: Estimating the value of mines

The average price of diamonds per carat in Angola has been set to $200 by the field experts consulted. As sources indicate Gema Dourada concessions to amount to 1 million carats, their estimated value is $200 million. A paper on the mineral industry of Angola by George J. Coakley claims that at least two of the Diagema, Kupolu and Somicoa concessions amount to 400,000 carats. This value is taken as the minimum estimated one, with a consequent dollar value amounting to $80 million. The $12 billion value of the Lemonosov deposit has been provided by Rough & Polished Ltd, a company specialised in news and analytics for the mining sector. The net present value of Forsys’s Namibian uranium concessions has been taken from the company’s website, together with the estimated lbs of uranium stored in the site, 90.7. The average uranium/lbs price ($39.25) at the time of the project has been used to calculate the deposit’s value. Because of the deep uncertainty and lack of data on the true amount of precious resources in the considered mines, these estimations have to be treated with caution. Novel data might yield better estimates.