Where Travel Platforms like Airbnb have Transformed Europe’s Tourism

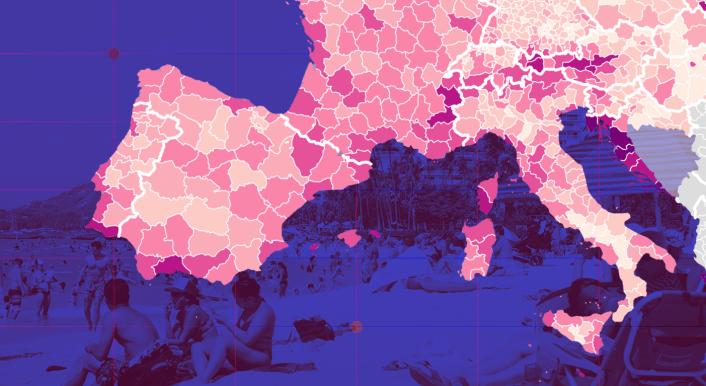

Short-term rentals through online platforms are surging – far outpacing traditional tourism. Using local-level data, CORRECTIV.Europe reveals for the first time where EU residents are confronted with especially high numbers of visitors.

At a glance

- In the past few years, tourism in Europe has changed drastically.

- A constantly increasing number of people are booking short term accommodations through online platforms like Airbnb, which are often less regulated.

- Traditional hotel tourism is seeing little to no total growth.

- An analysis by CORRECTIV.Europe shows which places are most affected by this shift.

The sea glints and sparkles under a brilliant blue sky, picturesque whitewashed houses adorn the hills: the Greek island of Santorini has survived and thrived on its beauty, attracting travelers from all corners of the globe. But it is precisely this which has become a problem. In summer, throngs of visitors push their way through the narrow streets; water consumption on the parched island more than doubled within a decade – and many people working there can no longer find affordable places to live.

Not only on Santorini is business with short term rentals skyrocketing. Across the entire EU, more than 854 million guest nights were booked via online platforms last year, representing an increase of 67 per cent vis-à-vis 2019. A very different picture emerges regarding guest nights at hotels, commercial holiday rental providers and campgrounds: these were at approximately the same level as before the outbreak of the coronavirus pandemic. These figures are according to data sourced from the European statistical office Eurostat.

An Analysis by CORRECTIV.Europe shows for the first time just how significant the impact of short term rentals via the platforms Airbnb, Booking, Expedia and Tripadvisor is for local residents. We calculated the number of guest nights booked via these platforms throughout every district of the EU and the countries organised within the European Free Trade Association and compared these to the number of local residents. We found that this indicator, known as tourism intensity, was not especially conspicuous in renowned hotspots like Barcelona or Paris, but rather in smaller places.

Greek islands top charts for Airbnb tourism

Of the ten European regions with the highest intensity of bookings through Airbnb and the like, one is in Spain, four are in Croatia and five are in Greece. The Cyclades island group, which includes Santorini, tops the charts with more than 46 guest nights per island resident. By contrast, in Barcelona – which had one of the highest absolute numbers of guest nights – there were just 2.5 guest nights for each resident.

The enormous increase in this form of tourism has also been observed by tourism economist Anna Burton: “This trend continued to rise during the COVID-19 pandemic.” According to Burton, many hosts took advantage of this to generate additional income at a time when hotels were forced to close. “These platforms have changed the market fundamentally – which is exactly why they need to be monitored much more closely,” says Burton, who works for the Austrian Institute of Economic Research.

Methodology

Guest nightsThe number of guest nights reported by the European statistical office Eurostat is calculated from the number of guests and the number of booked nights. Example: Two people stay for five nights equals ten guest nights.Platform tourism

The data for the analysis by CORRECTIV.Europe were sourced from Eurostat. These data are available at the NUTS 3 regional level. In Germany, this corresponds to districts.

The data on guest nights booked via the online platforms Airbnb, Booking, Expedia und Tripadvisor can be accessed here.

Based on the agreement reached in 2020 between the EU Commission and the platforms Airbnb, Booking, Expedia and Tripadvisor, these four providers are obliged to submit data directly to the statistics authorities about short term rentals retroactively from 2018. Bookings at hotels or campgrounds are explicitly excluded from this.

This, according to Eurostat, has “filled a long-standing information gap: holiday homes, apartments and rooms in private buildings often fell outside the scope of official tourism registers.” The new data provides a more complete and reliable picture of the constantly changing landscape of European tourism.

Traditional tourism

Guest night numbers for traditional tourism were also sourced from Eurostat. These pertain to nights at hotels, commercial holiday rental providers and campgrounds. They can be viewed here. Since the data set at NUTS 3 level only begins from 2020, we used the next largest level (NUTS 2) for the 2019 data.

Tourism intensity

To calculate the so-called tourism intensity, we divided both data sets by the number of residents in the respective region: the number of guest nights relative to the number of residents.

In a German-wide comparison, at around 3.2 million guest nights, Berlin had the highest absolute number of bookings of short term rentals through online platforms in 2024. This does not even amount to one guest night for each resident of the city.

The German areas with most online bookings per resident were the rural districts of Vorpommern-Rügen (2.3 million guest nights equating to 10.6 per resident), Garmisch-Partenkirchen (729,221, 8.16 per resident) and Nordfriesland (1.3 million, 7.7 per resident). Even in the districts with the highest level of tourism intensity ensuing from online platform bookings, the number of guest nights per resident was still relatively low compared to other European regions.

Strikingly, in the major cities of Berlin, Hamburg and Munich, numbers were much lower than before the outbreak of the coronavirus pandemic. This could be partly attributable to authorities cracking down harder on business with unregistered holiday homes there in recent years.

Tourism plays a crucial role for many EU regions, although there are considerable differences between the countries. Most significant in 2019 was Croatia, where tourism contributed 11.3 per cent to Gross Value Added; at the other end of the spectrum, tourism added just 1.2 per cent to GVA in Luxembourg. The EU-wide average was 4.5 per cent.

Mass tourism leads to social conflict

In many places, tourism contributes to water scarcity. Emissions ensuing from the tourism industry contribute to the exacerbation of the climate crisis – from which the industry itself also suffers. Climate change is not only causing further degradation of tourist attractions such as snow, beaches and sea cliffs; local agriculture and thus also food production are affected, as this requires water too.

Especially at risk are the very popular holiday destinations in southern Europe and along the Mediterranean. Although several international agreements have been reached – such as the Glasgow Climate Declaration, which aims to halve the sector’s emissions within the next decade – experts now believe the current measures will not suffice.

“If the current emission trend persists, mass tourism in the form we know today will become increasingly difficult and expensive to sustain in coming decades,” explains Robert Monjo, Head of Research for Climate and Meteorology at the Spanish Fundación para la Investigación del Clima.

EU-wide data on holiday homes: a good start, but not enough information

The fact that EU-wide data for online bookings of short term rentals is available at all is attributable to the agreement reached in 2020 between the EU Commission and the platforms Airbnb, Booking, Expedia and Tripadvisor, whereby the providers submit data directly to the statistics authorities retroactively from 2018. This, according to Eurostat, has “filled a long-standing information gap: holiday homes, apartments and rooms in private buildings often fell outside the scope of official tourism registers.”

But the data do not tell the full story. In major cities such as Barcelona, business with private holiday home rentals is highly concentrated in individual neighbourhoods. The data from Eurostat, however, provide a total figure for the city. It is also not possible to identify how many private and how many commercial providers there are in a given location, let alone what prices they charge. The data on platform tourism and the traditional register cannot be correlated because, according to the methodology, it is not known whether there is a certain degree of overlap.

The number of guest nights in traditional tourism is still higher overall. However, comparing the development of both sets of figures reveals that platform tourism has increased sharply in almost all countries, whereas traditional tourism has declined in many.

The EU Commission hopes more transparency will lead to fewer illegal offers. Such offers are a problem in many cities, and the consequences can extend beyond competition on the housing market: “In extreme cases, regions can in this way also lose out on tax revenue,” says Burton. “At the same time, locals can become massively burdened by rising living costs.”

According to Burton, the point at which mass tourism becomes overtourism is when everyday life is hampered due to tourists. “Indicators include overburdened public transport, disproportionate price increases at restaurants or extremely high housing costs.”

In particular, areas with limited housing from a geographical perspective are significantly impacted: “In extreme cases, residents may no longer be able to afford to live locally, needing to move further out and potentially commute to work daily,” explains Burton. Multiple studies have demonstrated that a higher density of Airbnb listings also contributes to higher housing rents and purchase prices.

Tourism experts: “The way we travel will need to change”

Not only tourists staying in private accommodation have an impact: “Whilst overnight stays are a good indicator of how busy an area is, it is crucial that day visitors are also taken into consideration,” says Burton. “They can be very problematic in some areas.”

The needs of tourists are often given precedence over the needs of locals, as was seen in the Spanish region of Andalusia, where last year a scarcity of drinking water was already reported as early as spring. Despite tourists generally consuming two to three times more water than locals, politicians consistently decided to make more water available to tourists than to locals.

Nevertheless, tourism will not disappear, says meteorologist Monjo. However: “The way we travel will need to change, with more attention to sustainability, fewer long-haul trips, and possibly higher costs.”

Some places have meanwhile introduced limitations: Barcelona has announced plans to phase out all Airbnb apartments by 2028. This summer, Santorini has introduced a tax for day visitors disembarking from cruise ships. An acute water scarcity was reported by 15 of the island’s villages in May.

- Text and research: Lilith Grull, Frida Thurm

- Data and visualisation: Luc Martinon

- Design: Mohamed Anwar

- Editing: Justus von Daniels

- Fact checking: Marius Münstermann

- Communication: Esther Ecke